Trade Symbols

Every strategy trades a symbol, such as an index, stock, ETF, futures contract, or currency pair. You can create as many symbols as necessary. With the symbols, it's possible to define some basic information used by the various tools available. Among the information, You may set trading costs, minimum and standard volumes, as well as the margin needed to trade the asset. Several strategies can trade a symbol, and any changes to the symbol's settings will affect all of them.

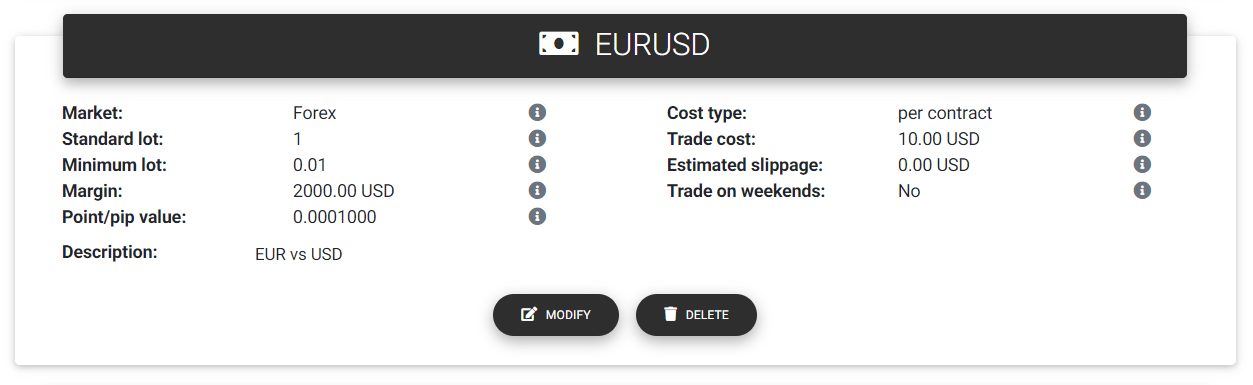

Symbol details

When you create a new symbol, you must fill in the following information:

Name: Name of the symbol. You can usually use the trading instrument's name, such as EURUSD, Gold, DAX, etc.

Market: The primary type of this symbol. You can choose an option from the following: Futures, Stocks, Forex, Indexes, Options, CFDs, Metals, Commodities or Cryptocurrencies.

Standard lot: Specifies the standard volume used as a reference for trading. For example, for Forex the default lot will be 1.0, while for stocks, you can use 100.

Minimum lot: The minimum volume allowed for trading, which will also control the volume increment. With Forex brokers that support micro-lots, this minimum volume could be 0.01. On the other hand, for some futures contracts, the smallest possible volume is 10.

Point/pip price change: If you like to see the trading results in points or pips, define in this parameter how much a variation of a point or pip represents in the asset's price. For example, considering a currency pair with 5 digits, and if you want to present the results in pips, this field must be filled in with the value 0.0001. For an index symbol, price is often represented in points so that this field can remain with a value of 1.0.

Currency: Currency in which margin and cost information are indicated.

Margin: The margin requirements set by the broker to start a new trade. Some assets may have different margin values for day trading and swing trading. In these cases, you can consider here the highest value. Optionally, if you have strategies for both day trading and swing trading, you can create two symbols, one for each type of trading period.

Estimated slippage cost: This is a value representing the cost of common slippage in market entry and exit orders. This cost must refer to a standard lot and is applied to the open and close orders when building the reports.

Type of transaction cost: Defines how the app calculates trading costs. You can select per contract like in futures and Forex, or per order, which means that the brokerage value is applied filled order and is independent of the volume (stocks market).

Trading cost: Indicates the value of trading costs based on the selection in the previous field. The inclusion of trading costs is optional and can be kept as zero if you are not interested in computing these values.

Trade on weekends: Indicates whether the asset can be traded during the weekend, on Saturdays and Sundays.

Description: This is a description field for your control.

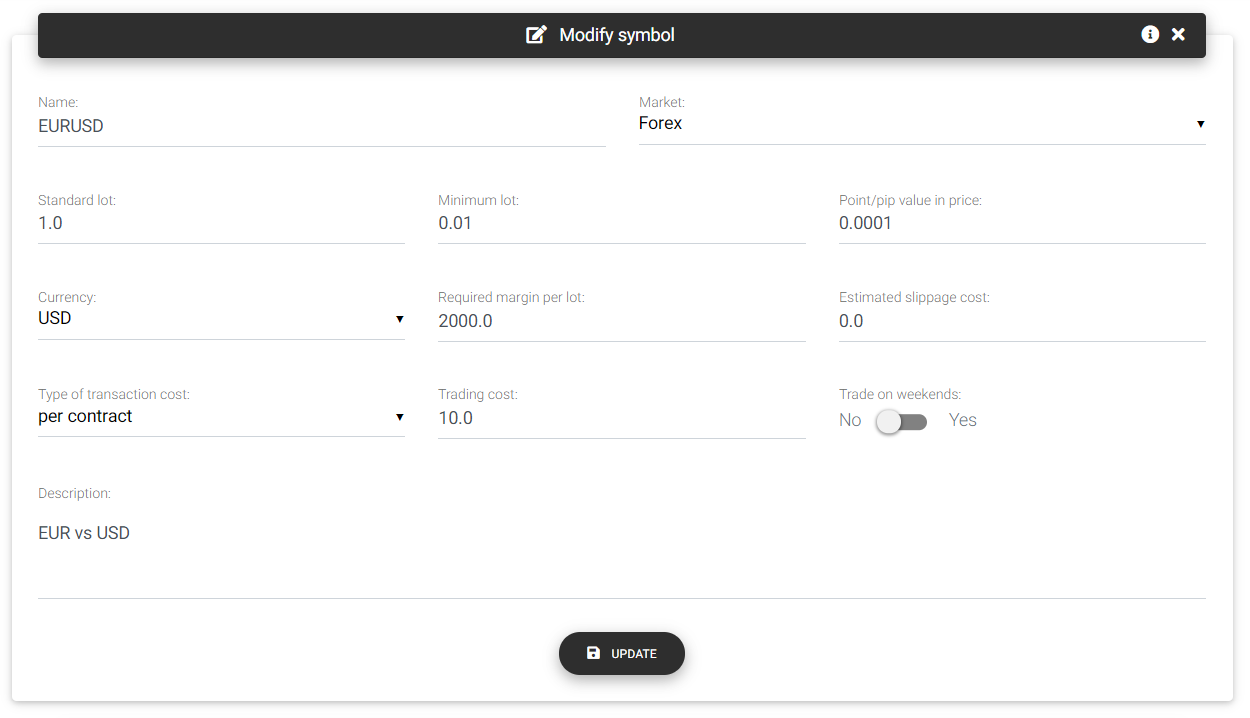

Modify symbol settings

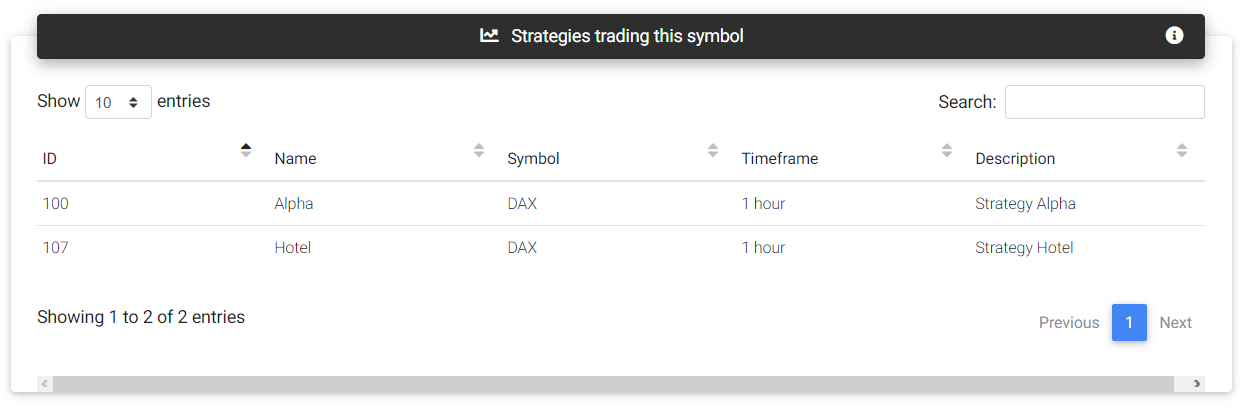

It is possible to access the page with specific information of a symbol through the top menu or dashboard. You can change the symbol settings on this page and delete a symbol that you no longer use. Furthermore, you find a table with all the strategies that trade this symbol.

Strategies using the symbol

Read next: Benchmark Symbols