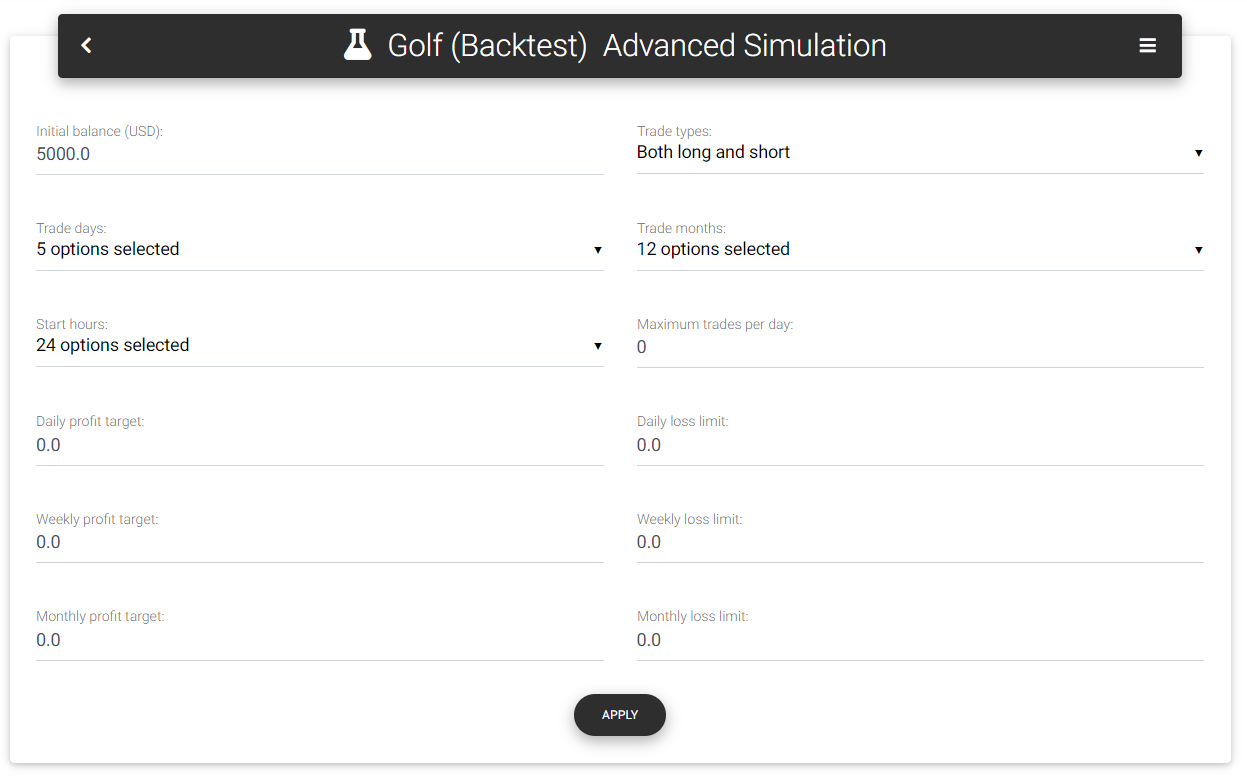

Advanced Simulation

This tool allows you to carry out various simulations using history directly without performing another backtest with these settings. For example, if you notice that the strategy's result is not good enough on a specific day of the week, you can remove all trades done on that day and compare it with the original result.

Simuation parameters

When you open the advanced simulation tool, you will have a form with several fields for selection. By default, the selected options accept all trades in history, so the result of the filtered strategy will be the same as the original (you can notice that both curves are equal in the comparative chart). After changing some parameters in the form fields and clicking on the "Apply" button, the app will perform a new calculation excluding trades that do not meet the imposed conditions.

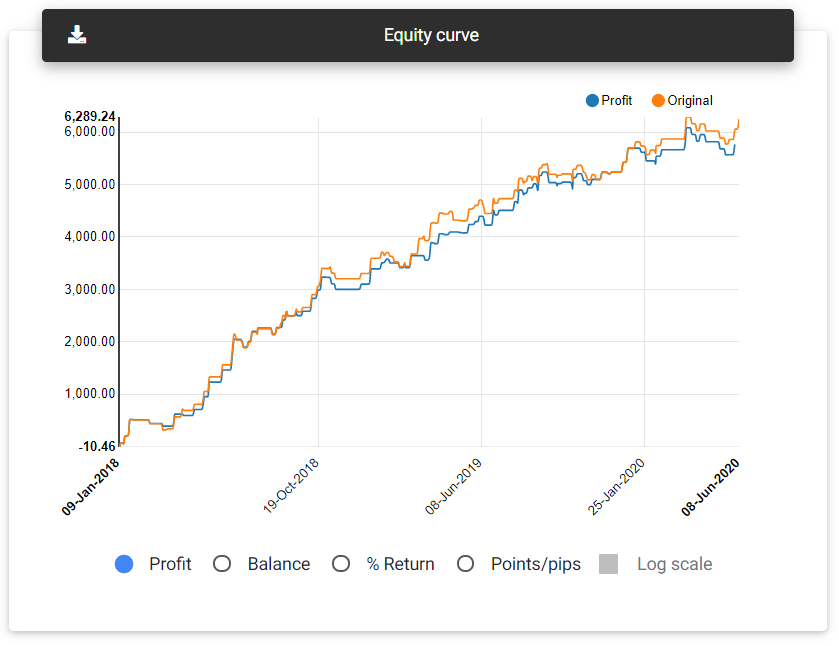

The report presented in this tool is very similar to the standard strategy report, so we will not describe each field here, and the same considerations made in the previous section are valid. You have a visual comparison between the filtered results and the original on the profit/balance growth chart, which will show curves for both scenarios.

Equity curve

Below, you find a description of the simulations available in the tool.

Trade types: Selects the kinds of trades allowed with the options "Both long and short" (all trades), "Long only" (only trades that started with a buy transaction), or "Short only" (only trades that started with sell transaction).

Trade days: A selection of days of the week on which it is allowed to trade. Days that are not marked will have the corresponding trades excluded from the analysis.

Trade months: Indicates a selection of months in which it is allowed to trade. Months that are not marked will have the corresponding trades excluded from the analysis.

Maximum trades per day: Sets a limit on trades in a single day. After the limit is reached, new trades will be excluded from the analysis until a new day is verified. Zero keeps all the trades.

Daily profit target: Total profit amount on a single day that will be considered a limit to avoid new trades. If it is zero, no daily profit limit is applied. Once the sum of profits from closed transactions is greater than or equal to the defined target, new trades on the same day will be excluded from the analysis.

Daily loss limit: Accumulated loss on a single day that will be considered a limit to avoid new trades. Although it represents a loss, it must be filled with an absolute value (greater than zero). If it is zero, no daily loss limit is applied. If the sum of the results from closed operations represents a loss greater than or equal to the defined limit, new trades on the same day will be excluded from the analysis.

Notice: When simulating profit or loss limits, the final result can exceed the defined limits since the app verifies only closed trades. It does not simulate a trade closing precisely at the limits, as could be made by an expert advisor.

Weekly profit target: Total profit amount in a week that will be considered a limit to avoid new trades. If it is zero, no weekly profit limit is applied. Once the sum of profits from closed transactions is greater than or equal to the defined target, new trades in the same week will be excluded from the analysis.

Weekly loss limit: Accumulated loss in a week that will be considered a limit to avoid new trades. Although it represents a loss, it must be filled with an absolute value (greater than zero). If it is zero, no weekly loss limit is applied. If the sum of the results from closed operations represents a loss greater than or equal to the defined limit, new trades in the same week will be excluded from the analysis.

Monthly profit target: Total profit amount in a month that will be considered a limit to avoid new trades. If it is zero, no monthly profit limit is applied. Once the sum of profits from closed transactions is greater than or equal to the defined target, new trades in the same month will be excluded from the analysis.

Monthly loss limit: Accumulated loss in a month that will be considered a limit to avoid new trades. Although it represents a loss, it must be filled with an absolute value (greater than zero). If it is zero, no monthly loss limit is applied. If the sum of the results from closed operations represents a loss greater than or equal to the defined limit, new trades in the same month will be excluded from the analysis.

Read next: Money Management