Highlights

Analysis

Execute in-depth analysis of trading strategies using data from backtests as well as live accounts.

Portfolios

Create multiple portfolios, grouping strategies any way you like it.

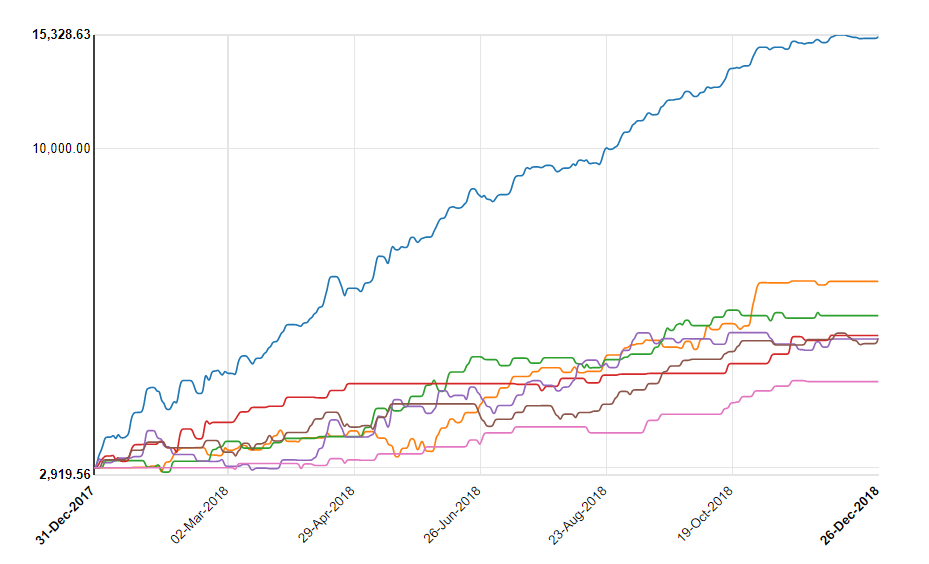

Global returns

Mix strategies from different timezones and currencies, checking the compound result in a currency of your choice.

Data

Seamless integration with MetaTrader 4 and 5. Load data from any platform using standard history file formats.

Reports

Receive daily and weekly reports by email, showing the results on real and demo accounts.

Share

Easily share your strategies development and portfolio selection with your groups or followers.

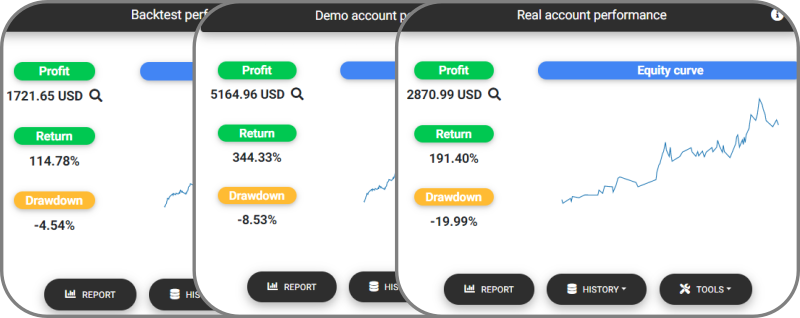

All history in one place

Control the life cycle of a trading strategy, comparing the returns from backtests and live accounts.

Learn more

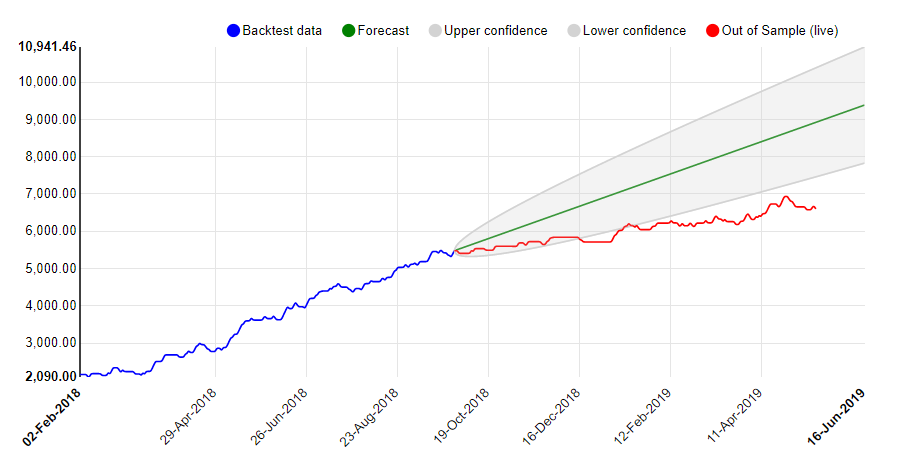

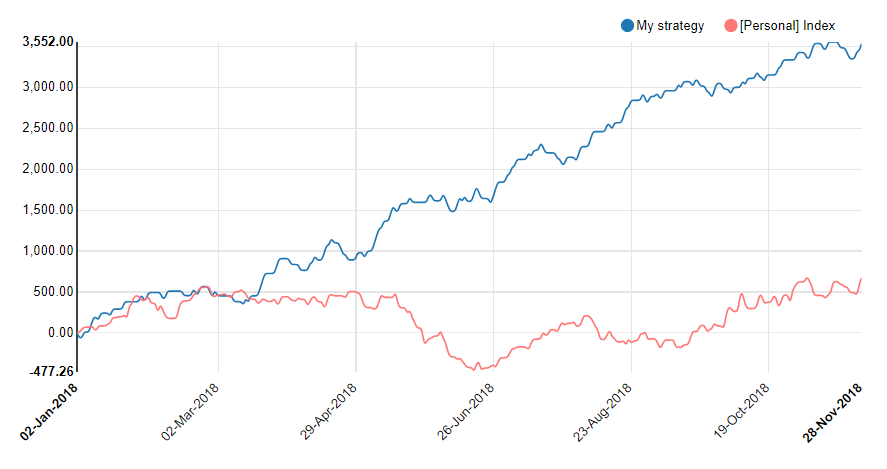

Compare live returns with forecasts

Calculate equity growth forecasts based on backtest data and compare them with live trading results.

Learn more

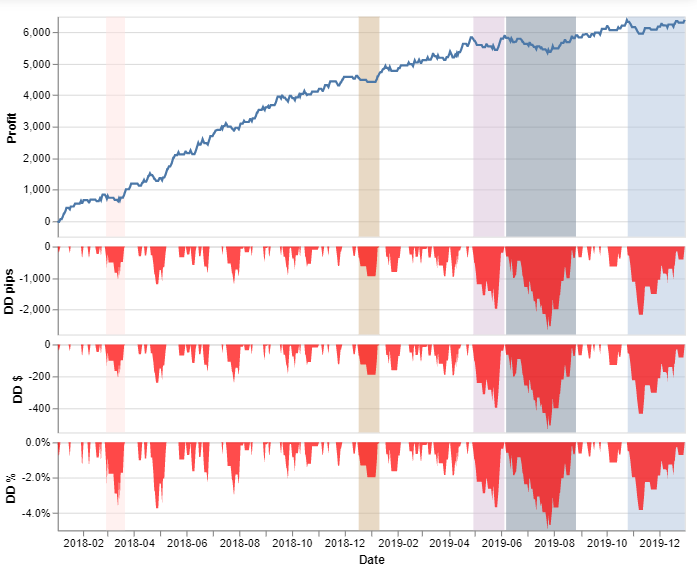

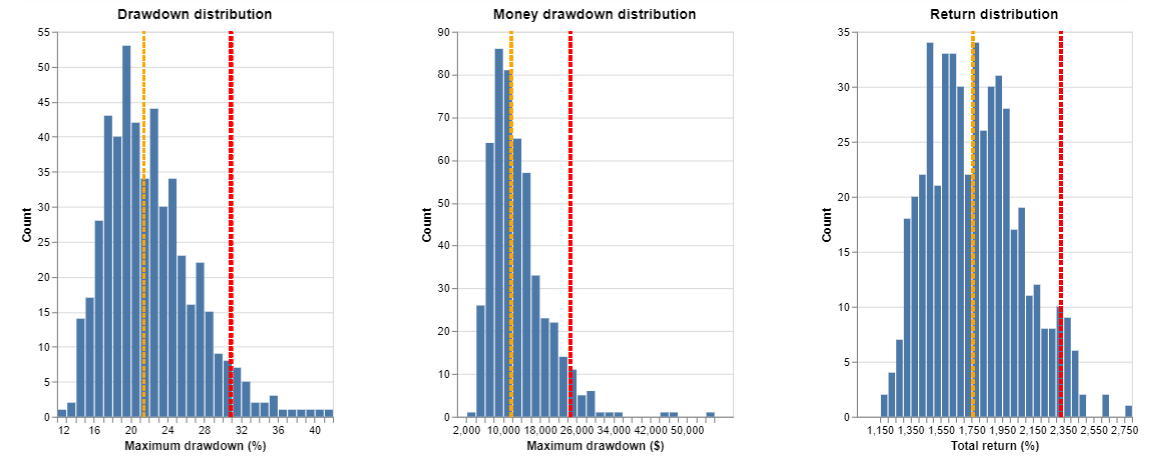

Drawdown periods

Verify the length of drawdown periods and their amplitude for strategies and portfolios.

Drawdown charts are provided either in money value, points, and percentage of the balance.

Learn more

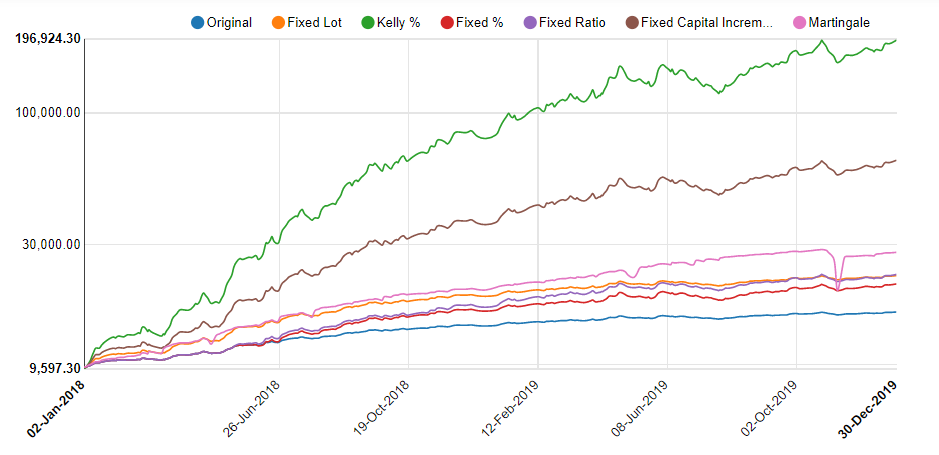

Money management

Simulate and tweak money management methods to increase your trading profits.

Learn more

Monte Carlo

Perform Monte Carlo simulations, including money management strategies, to estimate possible drawdowns and allocate capital properly.

Learn more

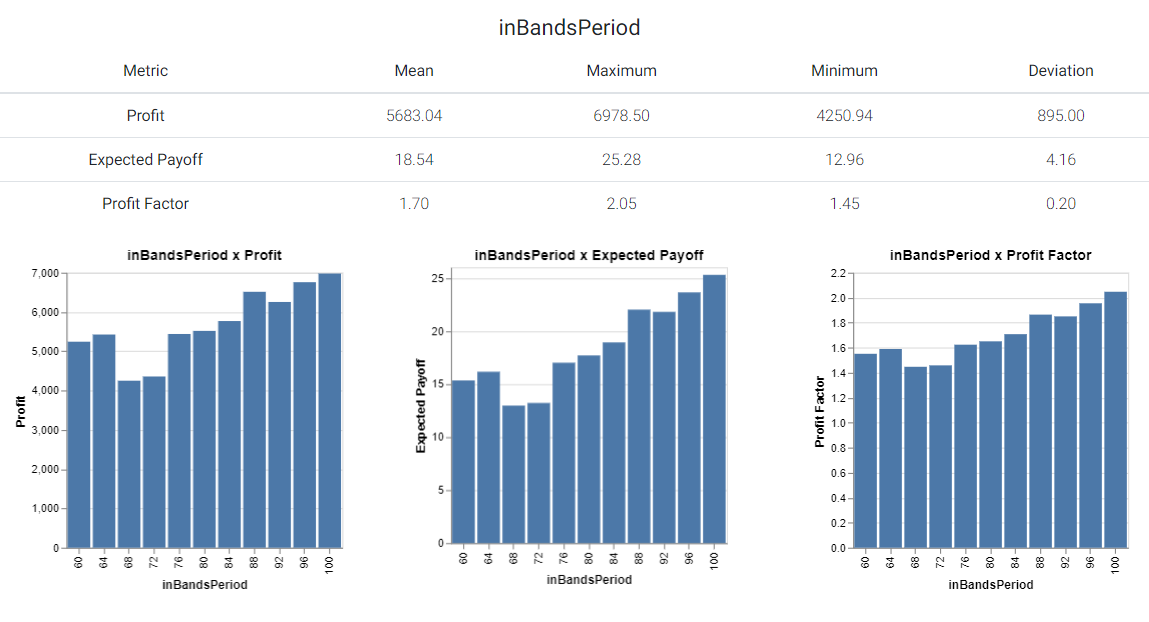

Optimization analysis

Load strategy optimization data and verify the distribution of results and the impact of parameter changes on system performance.

Learn more

Benchmark strategies and portfolios

Compare the returns of your strategy or portfolio with benchmark symbols. We provide some standard symbols, and you can also create personal benchmarks.

Learn more

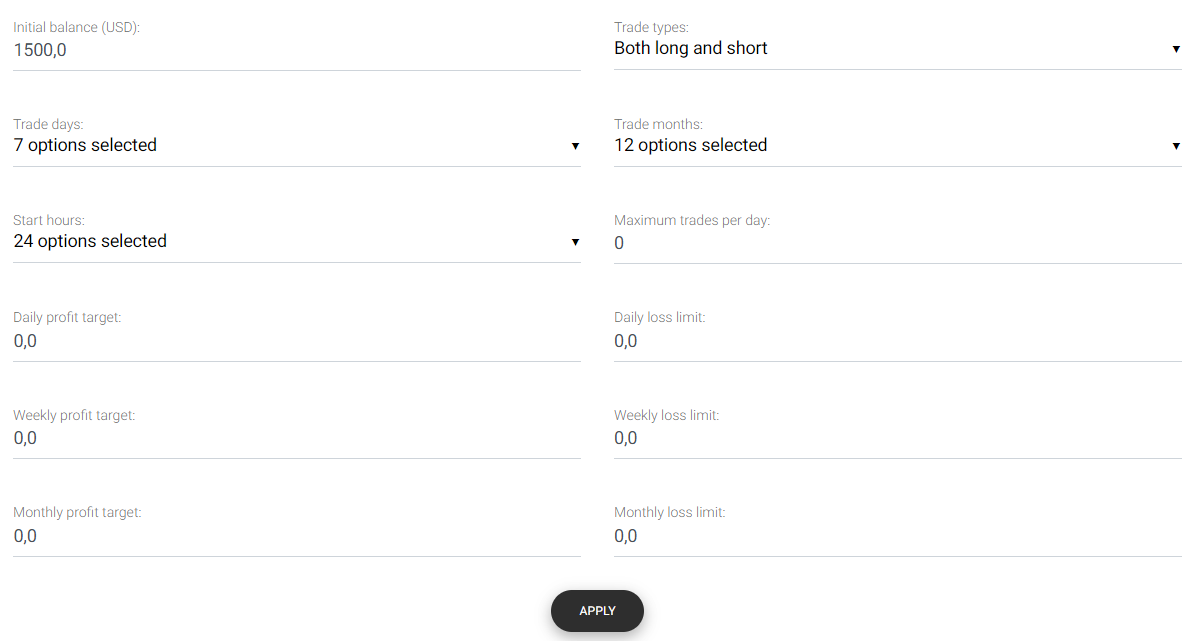

Advanced simulations

Simulate changes in the strategy using the history data directly, without a new backtest execution.

- Restrict trading hours

- Avoid trades on specific week or month days

- Perform only long or short trades

- Limit the number of trades in a day

- Define profit and loss limits

Learn more

The power of portfolios

Combine multiple strategies in portfolios and check the compound results.

Portfolios work like logical groups, using the history of each strategy individually.

Strategies may have historical data in multiple currencies and work across different time zones.

Learn more

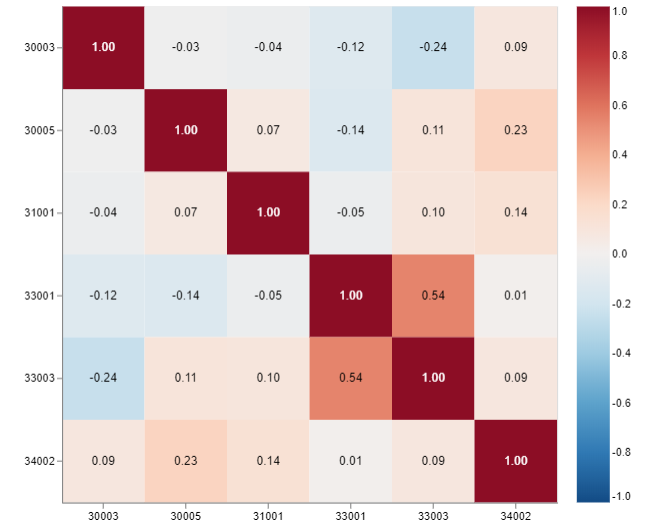

Correlation

Analyze strategies correlation in a portfolio using daily, weekly, and monthly returns.

You can also check the probability of joint trades between strategies in the same hour, period, and day.

Learn more

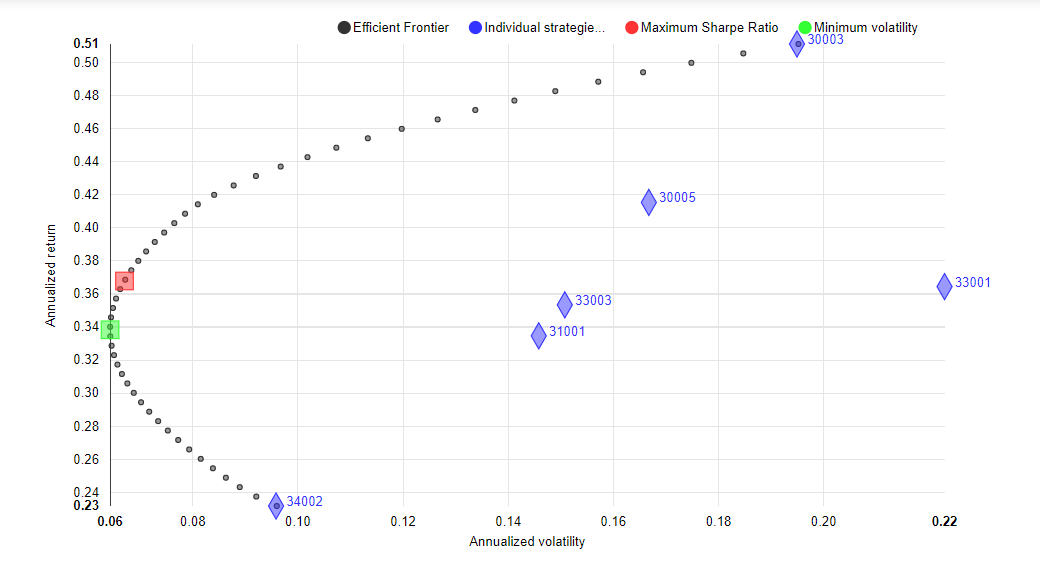

Allocation

It might be interesting to invest more money in some strategies than others.

With our allocation tool, you will have an idea of the risk/return of each strategy.

The portfolio's capital allocation can be optimized to have the highest expected return for a given level of risk.

It is possible to find a set of optimal allocations using the Efficient Frontier concept, introduced by Harry Markowitz.

You will get some suggestions to allocate capital on strategies aiming for minimum risk or maximum Sharpe Ratio.

Learn more

Our pricing plans

Sign up now, creating a new account for free, and start using the app.

If you like it, upgrade to a subscription plan of your choice and get even more resources.

Compare all features

Free

0

-

Unlimited strategies

-

Unlimited portfolios

-

Backtest and live history

-

Optimization analysis

-

Strategies correlation

-

(Always free, with Ads)

Basic

5

-

All free features plus:

-

Advanced simulation

-

Monte Carlo analysis

-

Money management

-

Portfolio allocation

-

(Price for 6 month billing cycle)